The NatWest (LSE:NWG) share price was down as much as 18% at one point on Friday 27 October, after the company unveiled its Q3 results.

The bank, still partially owned by the British government, missed expectations slightly with its third-quarter results despite a 33% rise in profits.

What spooked investors was the bank’s commentary on its net interest margin (NIM).

Should you invest £1,000 in NatWest Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if NatWest Group made the list?

NatWest’s NIM — the difference between lending and saving rates — fell to 2.94%, from 3.13% in the second quarter and 2.99% the year before.

The narrative is that NIMs have peaked across the industry as banks compete for savers. This was reinforced by results from Barclays and Lloyds earlier in the week.

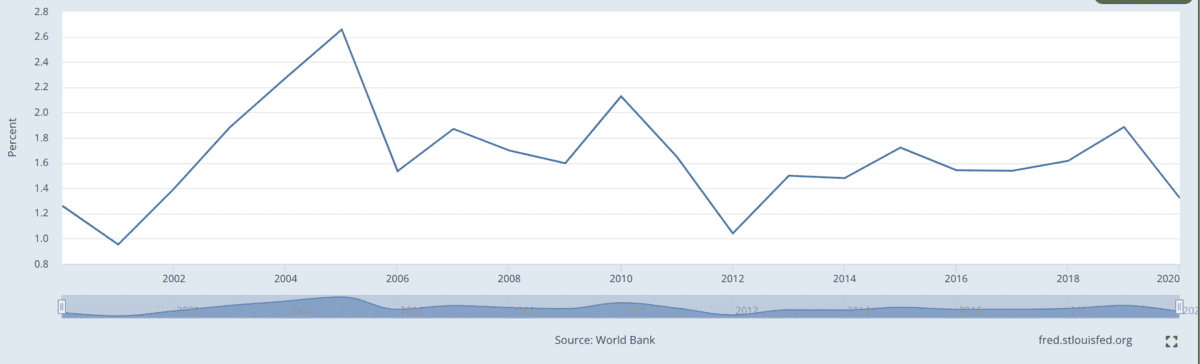

NIMs in context

As the below chart highlights, NIMs haven’t been so high in the UK at any point in the last 20 years.

While NIMs might have peaked, they’re still very high. And it’s unlikely that’s they’re going to fall quickly.

One key factor contributing to the forecast resilience of NIMs is the delayed transmission of the impact of higher Bank of England interest rates to the broader market.

This delay is due to the prevalence of fixed-term mortgages and similar financial products.

While these fixed-rate loans remain in effect, they shield borrowers from immediate increases in their interest expenses.

As time passes, more and more Britons will move to higher rate borrowing products, further adding to NIMs.

Is NatWest oversold?

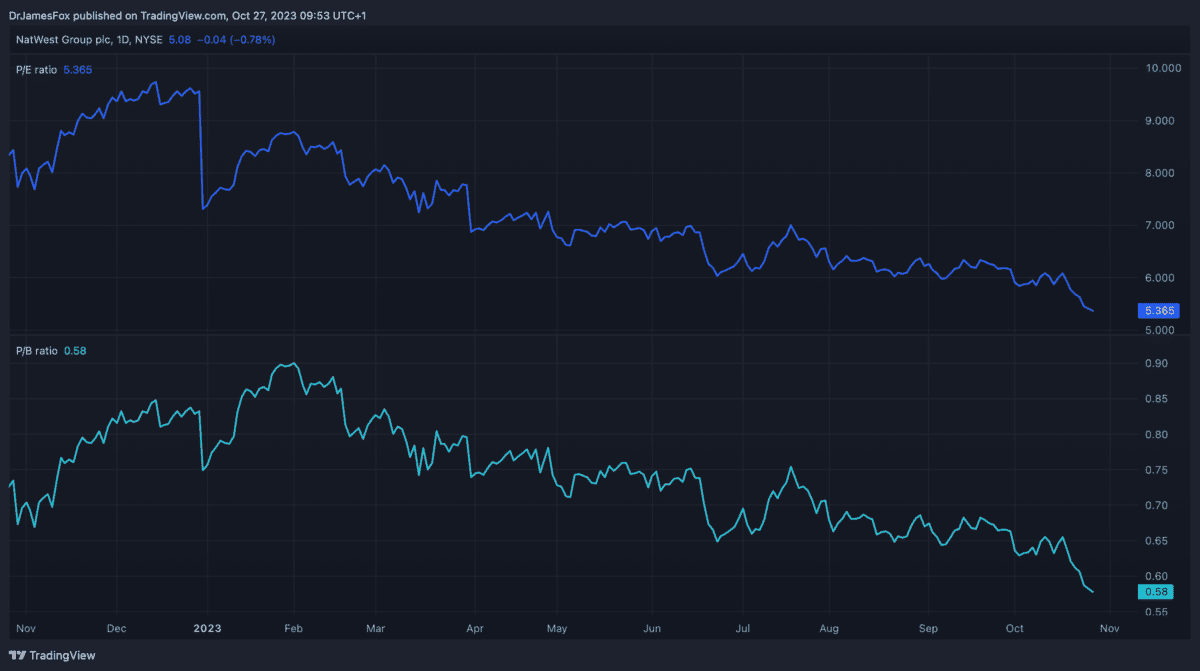

NatWest’s median price-to-earnings ratio over the past 13 years is 10.8 times. However, right now, NatWest is trading at just 5.3 times earnings. That’s also considerably lower than peers like HSBC at 6.5 times, but broadly in line with Lloyds.

UK banks just aren’t in favour with investors right now, despite a very positive medium-term forecast. I’ve been buying UK banks because I’m optimistic about their performance in the so-called ‘Goldilock zone’. This is when interest rates moderate to around 2%-3% — during which NIMs are elevated versus the last decade but default concerns fall.

The below chart highlights the falling P/E ratio and the bank’s price-to-book ratio of just 0.58 times. The latter suggests that NatWest is trading at a 42% discount to its net asset value. Among FTSE 100 banks, only Barclays is cheaper using this metric.

Looking at the Relative Strength Index, it also appears that the stock may be oversold, with a rating of just 28 — below the threshold of 30.

I’d buy more

If I had the capital available, I’d be buying more NatWest shares. I appreciate a hard landing would be problematic for banks, and of course, if economic conditions worsen, we could see a slew of defaults.

However, the most likely scenario is that interest rates moderate over the medium term, entering the Goldilock zone, while the UK economy stutters before eventually improving. While that might not be specific to NatWest, it’s among the cheapest banks with exposure to this improving environment through the medium term.